Streamline Your Payroll Process – Precision, Efficiency and Compliance All in One!

- Automated Payroll Calculations

- Tax Compliance Management

- Integrated with Self-Service Portal

- Payroll Reporting and Analytics

What makes payroll software essential for businesses?

Efficient payroll management is critical for business success and employee satisfaction. Manual payroll processes can lead to errors, delays and compliance issues. Payroll software automates calculations for wages, taxes and benefits, ensuring accuracy and regulatory compliance. This reduces mistakes and saves time, allowing businesses to focus on growth. Investing in payroll software enhances efficiency, reliability and overall operational effectiveness.

-

Precision and Compliance: Payroll software automates complex calculations, ensuring accurate and timely payments while maintaining compliance with evolving regulations.

-

Time and Resource Efficiency: Automates routine payroll tasks, freeing up valuable time for HR and finance teams to focus on strategic initiatives.

-

Data Security and Confidentiality: Protects sensitive employee information with robust security features, including encryption and secure storage.

-

Cost Savings: Reduces manual work and minimizes costly errors, leading to significant savings and avoiding non-compliance penalties.

-

Enhanced Employee Experience: Ensures timely and accurate paychecks, providing employees with easy access to their payroll information and improving morale.

-

Scalability and Flexibility: Adapts to growing business needs, accommodating more employees and complex payroll requirements as your business expands.

-

Comprehensive Reporting and Analytics: Provides detailed reports and insights on payroll expenses and tax liabilities to aid in financial planning and decision-making.

Payroll Software

Experience the Gold Standard in Payroll Software with Award-Winning Precision and Efficiency!

-

Next-Level Mobile App: Achieve seamless integration with all most needed functions and services, ensuring faster communication and transparency.

-

Ultimate Precision: Experience unparalleled accuracy with our system, built on robust quality standards and comprehensive process validations.

-

Unmatched Security: Guarantees flawless defense with state-of-the-art practices, keeping your system data and resources secure and protected.

-

Tailor-Made Solutions: Bespoke modules and features designed to fit seamlessly with your business's payroll requirements.

Join the 400+ companies that trust Timelabs’ comprehensive Payroll Software for seamless payroll management.

Take Control of Payroll: Solutions Crafted for Your Exact Needs!

Timelabs provides a sophisticated cloud-based & on-premise software solution featuring a robust payroll module that streamlines the complex task of monthly payroll processing. Our software effortlessly manages intricate calculations, deductions, statutory regulations and other challenging tasks. Designed to accommodate small, mid-sized and large organizations, Timelabs enhances payroll efficiency, thereby increasing productivity and profitability.

-

Seamless Payroll Control: Gain full control of your payroll system with our intuitive dashboard. Effortlessly manage all payroll operations with ease, thanks to a user-friendly interface designed to handle every command seamlessly.

-

Stay Ahead of Trends: Our payroll keeps you at the forefront with regularly updated features that ensure compliance with the latest standards and incorporate the most advanced payroll management practices.

Efficient Payroll Execution: Streamlined Solutions for Seamless Management

-

Flexible and Scalable: Designed to adapt to your evolving needs, our system provides flexible support for your payroll processes and scales effortlessly as your organization grows.

-

Actionable Insights: Receive timely alerts and updates on system health to identify and address potential issues before they escalate. Stay ahead of any challenges in payroll generation and processing with proactive problem-solving.

-

Advanced Payroll Automation: Streamline your payroll with automation that accurately processes employee data, ensures statutory compliance, performs advanced computations and generates detailed reports.

Core Features

Keeping Up with Compliance: Ensure salary disbursements align with legal frameworks and regulations.

Payroll Dashboards

A smart payroll dashboard offering a comprehensive overview of the system, complete with direct links and insights into payroll management.

Assign Pay Structures

Organize employees with similar pay components into a unified Pay Structure. Easily assign default component values for streamlined payroll management.

User-Defined Payroll Components

Admins have the flexibility to configure earning and deduction components based on company-specific requirements and applicable rules.

Salary Annexures

Effortlessly configure salary details as gross monthly and CTC. Additionally, perform bulk updates for basic rate revisions with ease.

User-Defined Pay Structures

Admins can seamlessly create and manage various Pay Structures by incorporating earning and deduction components and taxes, with the option to save and reuse configurations as needed.

Appraisals

Admins can schedule employees' next appraisal dates and receive timely alerts on the Payroll dashboard when appraisals are due.

Statutory Taxation

Admins can define and configure various tax components to meet the specific requirements of the company.

Loans & Advances

Employees can access their Loan and Advance ledger details, with the flexibility to adjust loans either through salary deductions or cash payments.

Asset Management

Add and manage assets, assign assets to employees, set expected return dates and release assets back to the pool when necessary. Track assets at the time of separation effortlessly.

Reimbursement

Manage monthly and yearly reimbursements by setting maximum limits on bill amounts. Easily add bills, build claims and track reimbursement processes.

Benefits - Bonus & Gratuity

Apply bonus rules and gratuity conditions with ease and precision, ensuring accurate benefit management.

Payslips

Employees can view and download their compensation details and all pay slips from their self-service portal as needed.

Full & Final Settlement

Efficiently process Full and Final settlements for outgoing employees, ensuring all pending data is reviewed and addressed.

Payroll Reports

Access a detailed breakdown of the company's salary payouts for each month.

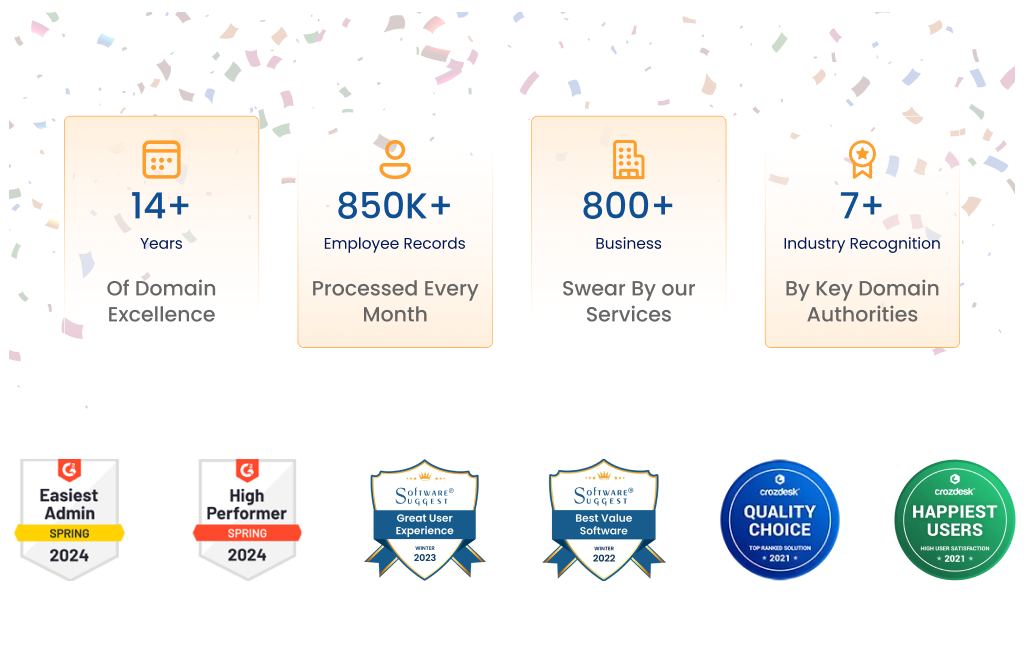

Why Timelabs?

Timelabs is one of the most endorsed and applied employee-self-service applications to transform diverse HR operations into automated mobile utility.

-

Easy-to-navigate dashboard that simplifies payroll management.

-

Eliminate the hassle of juggling multiple spreadsheets.

-

Flexible to accommodate the growing needs of businesses of all sizes.

-

Seamlessly integrates with Leave & Attendance data.

-

Protects sensitive payroll data with robust encryption and access controls.

-

Automates salary generation for efficiency.

-

Manages all statutory deductions effortlessly.

-

Consolidates all salary and compliance reports in one place.

-

Manage & Processes employee reimbursements instantly.

-

Ensures organized and systematic payment disbursal.

-

Access to a knowledgeable support team for any payroll-related queries.